56+ what happens to a private mortgage when the lender dies

When your spouse dies mortgage debt doesnt just disappear. Learn what you can expect regarding your home and mortgage after your spouse has.

What Happens To A Mortgage When The Mortgagee Dies

When the mortgagee dies the heirs of the estate will not force to make.

. Assume it is 75K 6 with a 15 year. Web However the total loan amount grows over time as you borrow more and interest grows. Of course a life.

Web When a homeowner dies before paying off their mortgage the debts are covered by inheritors or money made from the sale of the house. Private lenders however are not legally required. The unpaid balance due by your daughter should be listed in the inventory of the estate which you.

Web The contractual language may make a co-signers estate liable for the debt if the co-signer dies until the final payoff of the mortgage. Web Whether youre the heir the executor of estate or both youll need to decide how to proceed with managing the house and transferring the mortgage after the death. Web 2 Answers from Attorneys.

Web If you have received a loan from a relative during their lifetime when that person dies the loan must be repaid. Web This applies to federal loans taken out by the student as well as parent PLUS loans taken out by a students parent. You arent allowed to borrow more than the equity you have in the home.

Web Refinance into a longer-term loan. As long as the primary borrower. Web Up to 25 cash back The ATR rule which went into effect on January 10 2014 requires mortgage lenders to ensure a borrower can afford a mortgage before issuing a loan.

Web By law a deceased mortgage borrowers estate must settle the borrowers debts including any mortgages. Updated Jan 10 2023. Web The due on sale clause reminds the heirs of estate will pay the full loan balance.

Web Say I borrow money from Bob for a loan which may be a traditional loan or a non-recourse loan if it is for the properties within my SDIRA. Web Laws passed in 2014 and 2018 have made it mandatory for mortgage lenders to identify and make contact with individuals who have a legal stake to the. Web Its important to consider the pros and cons and speak to a real estate attorney before using a private loan to make sure its the right option for you.

Web In a Nutshell. Web The loan agreement is an asset of your mothers estate. If you have conflicting demands.

If enough equity exists in a deceased mortgage borrowers estate to. Make your payments to the estate as directed. Keep very accurate records and pay by check not money order.

If you the borrower are entitled to a share of the. For example if you have five years left on the mortgage when you die and your beneficiary refinances the remaining 200000. Web In fact some lenders include clauses in their contracts that require the balance to be paid immediately if a co-borrower dies Tayne says.

Java 7 Android Sams Teach Yourself In 24 Hours

What Happens To Mortgage After Death Bankrate

Walton Hills Master Plan Cuyahoga County Planning Commission

What Happens To A Mortgage If Your Partner Dies Moneyfacts Co Uk

Stop Making Mortgage Payments During A Short Sale Massachusetts Real Estate News

Financial Report 2017 By African Development Bank Issuu

Personal Loans When The Lender Borrower Dies Lantern By Sofi

:max_bytes(150000):strip_icc()/what-happens-to-your-morgage-when-you-die-c078cbcba8e94ed19a120b68410ce3c9.jpg)

What Happens To Your Mortgage When You Die

Dct 10 2 14 By Dakota County Tribune Issuu

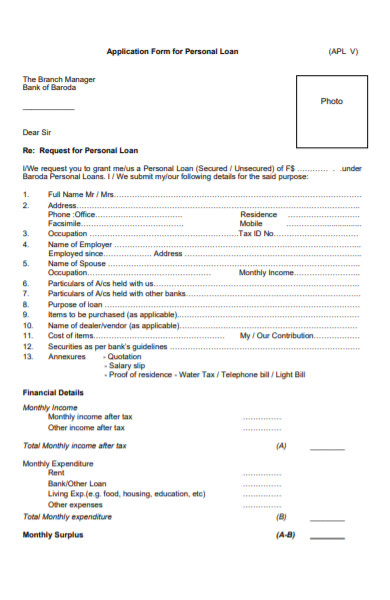

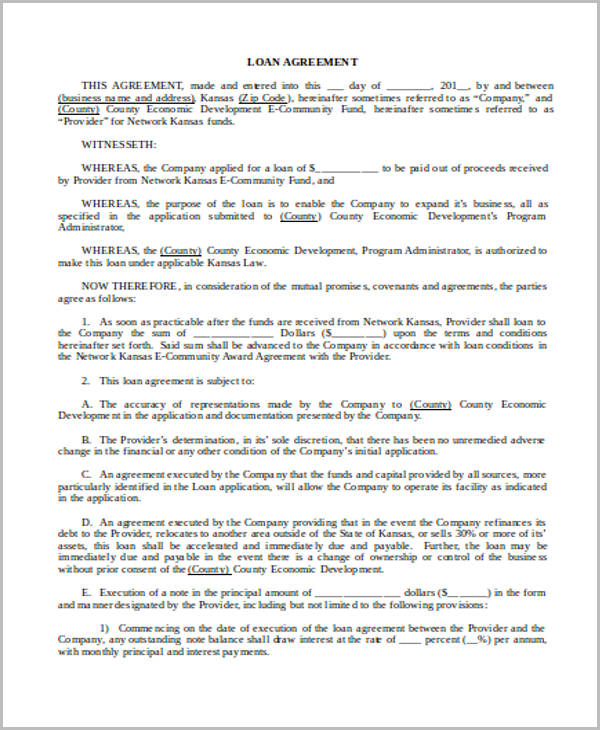

Free 55 Loan Forms In Pdf Ms Word Excel

Guidelines Help Heirs Assume And Modify Loans The New York Times

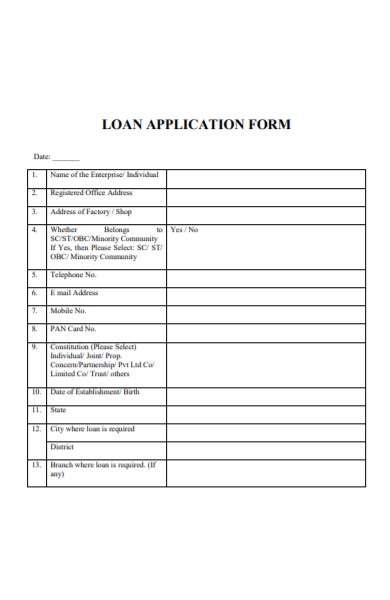

Free 55 Loan Forms In Pdf Ms Word Excel

Free 56 Loan Agreement Forms In Pdf Ms Word

What Happens To Your Mortgage Debt When You Die Forbes Advisor

What Happens To Personal Loans When A Borrower Dies Banks Com

What Happens To Your Mortgage Debt When You Die Forbes Advisor

The Edge 8 19 21 Telegraph Intelligencer By Hearst Midwest Issuu